The U.S. economy is full of uncertainty. Some experts predict we will see a recession this year, but other analysts don’t see that happening, at least not yet. This contradiction is causing uneasiness and driving a shift from discretionary spending to necessary spending, with consumers shopping at discount stores instead of higher-end retailers.

With economic uncertainty dampening consumer confidence, shoppers are focused on getting more value for their money by actively seeking discounts on everyday purchases through less-traditional channels, such as retailer loyalty rewards and cashback offers.

Consider the following mixed signals about the state of the economy:

- At the end of January 2023, the Commerce Department reported that in Q4 2022, the U.S. GDP grew 2.9%, and consumer spending increased 2.1% for the period.

- Weekly jobless rates in the 4th week of January were just 186,000 compared to the 205,000 expected — 186,000 new jobless claims is the lowest number since April 2022, reflecting a still-strong and very tight labor market.

- Although consumer spending was up, retail sales in December showed weaker-than-expected holiday shopping demand, with an overall YoY decline of 1.1%. Retail sales dipped slightly year-over-year in November and December 2022.

Andrew Hunter, senior U.S. economist for Capital Economics, said, “The mix of growth was discouraging, and the monthly data suggest the economy lost momentum as the fourth quarter went on. We still expect the lagged impact of the surge in interest rates to push the economy into a mild recession in the first half of this year.”

While no one has a foolproof crystal ball to predict whether a recession will or won’t occur in 2023, what can retailers expect, and how can they prepare for what could be a bumpy year ahead?

Consumers divert discretionary to necessary spending

Even though inflation is decreasing somewhat, it doesn’t mean prices are also falling. One side effect of this will be the potential for it to become “cool” to shop at stores that offer discounts, such as Marshall’s, Ross, etc. Because people are likely to be more mindful of how and where they spend to get the most value for the prices paid, they may change their behavior to shop not at, say, Nordstrom, but at JCP or Kohl’s instead.

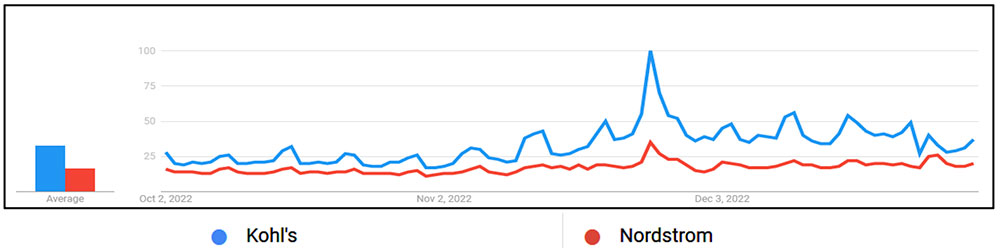

Indeed, according to Google Trends, demand for Kohl’s, measured by search queries, was roughly double that of Nordstrom in Q4 2022. In December, the increase in volume was even more pronounced:

The retail environment will get even more interesting in July and August if the economy officially enters a recession, as that is when the Back-to-School (BTS) shopping season officially kicks off and is viewed as necessary spending. School-age kids grow, and clothes no longer fit — so it’s not optional to go shopping!

We expect to see consumers shift purchasing to discount retailers to make their BTS budgets stretch further.

Tips for retailers to prepare for the Back-to-School shopping peak:

During BTS, higher-end retailers can highlight their “necessary” categories, such as denim and shoes for kids, by emphasizing product quality and the lasting impact on the product lifecycle. For example, high-end denim may cost $200 but will last much longer than a $25 pair of jeans. As a result, some consumers may still splurge on quality items that will last longer.

Discount retailers can advertise their low prices and great value for the money, especially during BTS.

All retailers can employ strategically placed discounts on “necessary” categories. Looking at past years’ trending product categories and comparing their performance this year can help to determine which ones need a boost in any recessionary environment.

Depending on their core customer demographic, stores will be affected differently

If a store traditionally attracts a higher socioeconomic class of customers, it may not be as profoundly affected if a recession occurs. This group is already very savvy and tends to comprise shoppers who already know how to find great deals and leverage coupons and cashback or loyalty program offers.

In a recession, “higher-end” stores may not see a significant drop-off in demand and sales as stores that address a less affluent customer with a tighter discretionary budget.

With this in mind, loyalty programs and cashback shopping rewards will be essential because that higher income group already uses cashback on their credit cards. They already know how to “work” these rewards and get the most value for their spend. But customers who shop at discount retailers might not be aware of such programs.

In general, we will see customers putting more thought and research before making purchase decisions to ensure they get the best deal.

Tips to increase or promote participation in loyalty programs:

To increase participation from non-members, conduct outreach campaigns for customers who may not be aware of the program or are atypical loyalty program members but are still looking for the best deals, offers, or rewards. Try tactics such as increasing signage promoting the program or incentivizing in-store employees to promote program sign-ups, or creating ways for customers to sign up quickly and easily, such as via QR code.

Make it impossible to ignore the loyalty program. Maximize an existing loyalty program to retain customers who are already engaged with the store by increasing the number of loyalty program offers or lowering the tiers through which members can earn rewards.

Brands without a proprietary loyalty program can still maximize their presence in separate online cashback rewards platforms by ensuring these offers are available to all shoppers. Because standalone cashback rewards programs typically are facilitated through traditional affiliate networks, brands with online affiliate programs should make sure publishers and platforms such as Capital One Shopping, Rakuten, and other third-party rewards publishers are approved.

Retailers may shift their marketing budget allocation

Advertising and marketing are often one of the first budgets to be cut when times are tough. After the 2008 recession, The Economist reported that the entire U.S. ad budget dropped by 13%. While it can feel instinctual and “right” for brands to cut costs — just as consumers do in tough times — doing so may leave the business in a less-competitive position when the market recovers.

During the “Great Recession” in 2008, brand strategy firm Millward Brown analyzed the results of companies who cut budgets vs. those who kept spending. While companies that cut their marketing spend enjoyed superior return-on-capital-employed during the recession, their effects were adverse after the recession ended. During the recovery, the brands which kept their marketing budgets intact achieved significantly higher return-on-capital-employed while gaining an additional 1.3 points of market share.

Tips for reallocating marketing budgets:

Take a closer look at media and marketing spend. Don’t panic-react and slash budgets across the board. Invest strategically in the channels that produce the best historical ROI and keep analyzing results to ensure productivity remains high. Instead of cutting budgets, redeploy spend to more productive channels.

However, note that channels not producing a directly attributable ROI may affect demand in others. For example, if a brand cuts back on TV ad spend, does traffic from non-paid sources, such as direct traffic or organic search, go down?

Instead, try a measured, stepped approach when cutting back budgets. This also refers to the phenomenon illustrated in the Millward Brown study — that reducing spending for the short-term may have long-term, as well as “indirect” ill effects.

With this in mind, brands should evaluate and focus efforts on the channels that are engaging the valuable consumers that ultimately convert to a purchase.

Brands should also consider investing more in retention tactics such as loyalty/rewards and personalized offers. Existing customers can be reassured and made to feel they are receiving good value for their money through value-added loyalty offers and highly relevant discounts.

Social Media

See all Social Media