Some e-commerce watchers predict that the growing trend of live shopping will probably not grow as extensively with U.S. customers as it has in the Asia-Pacific (APAC) market. Still, merchants should not mark down the potential it offers them for growing e-commerce sales.

Platforms such as TikTok and Facebook reportedly have concluded that live shopping will not spread in the U.S. Yet, many foods and consumer packaged goods (CPG) marketers remain invested in live commerce, which might help the expansion.

Shoppers can expect to see online merchants integrating at least some live commerce offerings in Western markets, with the “see-now-want-now” mentality spurred by live TV shopping on channels like QVC and Home Shopping Network having paved the way.

What marketers now call shoppable video ads is a new twist on the popularity of social media platforms and their influencer participants. By mimicking that approach with elements of socializing, entertaining, and shopping, online merchants can create new shopping media channels for consumers.

Jennifer Silverberg, CEO of CPG digital marketing firm SmartCommerce, maintains that the future of live commerce will be a distributed brand plus consumer-led model, not one led by retailers. This approach to video commerce makes more sense in shopping-forward categories, like fashion or jewelry, than in buying-forward categories, like CPG.

Brands plan to integrate commerce into entertainment without using the live shopping paradigm. Instead, she added, they are focusing on more authentic, distributed models (think micro-influencers) that blend video and commerce, consistent with the trend toward consumer-centric product discovery in general.

“Making videos shoppable is no more complex than making other links shoppable. Think banner ads, social posts, QR codes, whatever. It takes minutes to create a link for client brands, and it can be used anywhere,” Silverberg told the E-Commerce Times.

Survey-Supported Insights

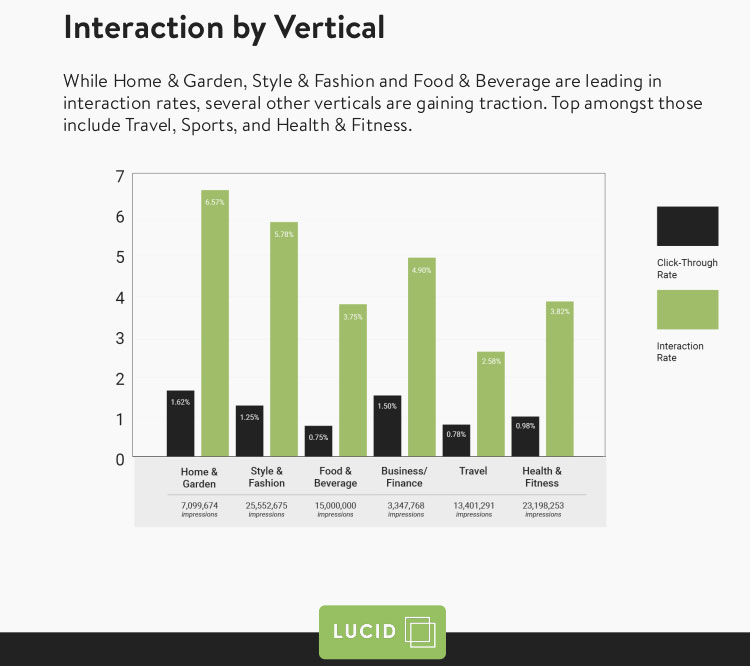

Researchers from digital ad company Kerv Interactive in July released in its first Interactive Shoppable Video Insights Report revealing how consumers are engaging with interactive video advertising. It offers merchants a new view of using this innovative format to drive brand awareness and sales, even during economically challenging times.

The report revealed that half of the 90 million Kerv and/or SmartCommerce users (over 40% of U.S. digital buyers) exposed to video ads with commerce or interactive capabilities engaged with video ads served from its platform within six months. Further, the results showed that the most engaging content categories included style and fashion, food and beverage, and home and garden.

“Last year was really the first time consumers saw shoppable video ads. All brands and agencies are quickly realizing they have a massive opportunity to engage with more people than ever before through immersive video experiences that connect content with commerce,” Kerv COO Marika Roque told the E-Commerce Times.

She pointed out that interactive and shoppable videos are shifting from a small portion of an agency’s media buy to a must-buy, especially as a forthcoming economic downturn may constrain budgets.

The report findings are based on data gathered from the Kerv platform from Oct. 1, 2021, to March 31, 2022. It represents data collected across over 500 video ad campaigns for over 100 brands and agencies that ran on the Kerv platform to understand consumer interest in shoppable videos.

Research Reveals New Ad Realities

Most interactors with shoppable ads are between the ages of 25-54. The average engagement is over 5% and ranges up to 50%. People over 50 had the highest interaction rates, with an average of more than 30%.

Roque noted that the top three verticals with the best interaction are style and fashion, food and beverage, and home and garden. Add-to-cart technologies have taken center stage in the CPG and food and beverage categories, partly because purchase behaviors differ from style and fashion.

“Moving the needle on consumer sentiment and behaviors becomes easier when you can tap into known high-performing ad placements,” said Laura Manning, vice president of measurement at digital measurement insights firm Lucid, a Cint company. “Across partnered studies, Lucid observed that Kerv’s interactive media delivered as high as 17x lift over our benchmark.”

Interactive technology dynamically adjusts interaction opportunities by product availability, flavors, and retailer locations. With interactive and shoppable videos, measurable add-to-cart rates and sales have increased.

The interactive experience needs to provide a deeper look at the products. That approach makes the need to digitally interact and differentiate a driver for a buyer’s consideration.

Added Cart Functionality

One appealing feature of interactive video is the “add to cart” functionality, which is driving the most impact on food and beverage categories.

Data from Kerv and its partner, SmartCommerce, suggests that over 10% of off-site cart transfers convert to actual purchases. The clicks from interactive and shoppable videos are significantly higher than standard ads, resulting in more products in carts and compelling more purchases.

“Since we measure all the way to the cart, way beyond the click, we can see when agencies are driving strong, intentional consumer clicks. We can also measure the opposite when consumer backout rates are high,” said Silverberg.

The benchmark for clicks-to-populated carts is 90%. Kerv’s interactive and shoppable video results consistently show completion between 96-99%. That means their engagement-based, in-video clicks are driving highly-qualified and motivated shoppers,” she added.

Shopper Buy-In Not Universal

Shoppable video is gaining steam across many formats, noted Roque, especially social and connected TV (CTV). According to eMarketer, the number of social commerce buyers is set to reach 102.6 million by the end of this year.

“Platforms like Instagram and TikTok are leading the way, allowing creators to link directly to products featured in videos,” she said. “Instead of using social media just for the discovery phase, brands can take consumers all the way through to purchase without requiring them to leave the app.”

In fact, 71% of TikTok users report they stop to shop when they see a product they like in video feeds and stories, offered Roque. More brands will turn to social commerce to drive revenue, she added.

For example, many brands are leveraging QR code technology to turn a static video advertisement into an interactive experience with CTV ads. Most consumers already have their phones on them while watching TV.

“By placing a QR code on an ad, brands give consumers a quick and easy way to find the products showcased in the ad,” explained Roque.

Then factor in the trusted source component, interjected SmartCommerce’s Silverberg. It is more about the influencer or brand and less about the platform.

“The platform is just the enabler. The key is that the consumer is open to discover[ing] any time, and video is a great enabler of that, she noted.

Moving It Further

Large technology companies and content companies are working on shoppable videos and bridging content and commerce in siloes, according to Roque. The companies claim they are building with the consumer at the core of their strategies and roadmaps. But they lack the insights to truly optimize the user experience.

“Standards need to be established based on real insights and adopted across all organizations to truly cater to the consumer and what singular behaviors we want to teach them so that adoption is more seamless and less complicated,” she said.

Silverberg thinks the most significant barriers are our habits and expectations. Also, many ad agencies still sell reach and frequency as key measures of success, or maybe CTR.

“But in the end, it is only the consumer choosing to take an action that is going to result in a purchase that really counts,” said Silverberg.

Social Media

See all Social Media