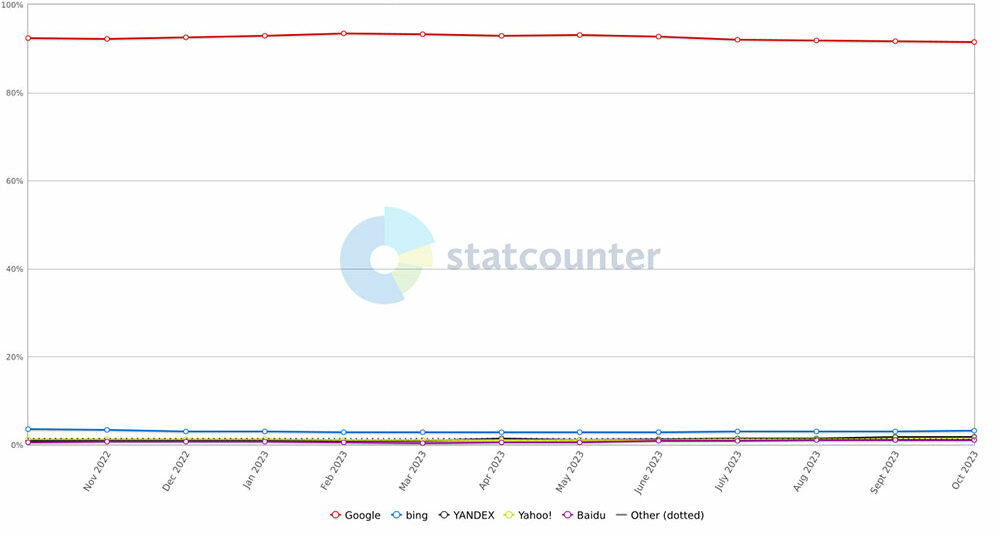

Despite Microsoft’s introduction of generative AI into its search engine Bing, the company has failed to cut into the share of market leader Google.

According to the latest numbers from market tracker StatCounter, Google’s market share of search in the United States in October was 88.1%, a slight increase over its October share in 2022 of 86.75%.

Meanwhile, Bing’s market share for the same period declined from 7.4% in 2022 to 6.92% in 2023.

Third-place player DuckDuckGo’s share also suffered a year-over-year decline from 2.34% to 1.91%.

Google’s search share was even stronger worldwide, garnering 91.55%, compared to Bing’s 3.11%.

Bing’s share of worldwide desktop searches was better at 9.14%, although still dropping from 9.92% in 2022.

In worldwide mobile searches — where Google has a dominant 94.93% position — Bing is ranked fourth (0.53%) behind Russian search engine Yandex (1.64%) and China’s Baidu (1.2%).

Search Engine Market Share Worldwide: October 2022 – October 2023

Source: StatCounter Global Stats

Microsoft’s Strategic Misstep in AI Deployment

When Microsoft announced in February that it was incorporating AI into Bing, some tech pundits predicted the move would give the company the lever it had long been searching for to pry some search market share from Google. Apparently, that hasn’t been the case.

A deployment decision by Microsoft may have contributed to its inability to convert its early AI advantage into a larger share of search, noted Greg Sterling, co-founder of Near Media, a news, commentary and analysis website, and a former contributing editor to Search Engine Land.

“Bing with ChatGPT was initially only available through the Edge browser,” he told TechNewsWorld. “Microsoft thought it would be a way to get people to download Edge. They should have just made AI immediately available across browsers.”

“That’s part of it,” he continued. “The other part is people are habituated to Google. Pundits underestimate the power of inertia and habit.”

Microsoft’s integration of AI into Bing has not given it any substantial traction in the competitive search market, observed Mark N. Vena, president and principal analyst at SmartTech Research in San Jose, Calif.

“Despite advancements in AI algorithms, Bing struggles to compete with Google’s entrenched dominance,” he told TechNewsWorld. “Users perceive Google’s search results as more accurate and pertinent, creating a challenge for Microsoft to attract and retain a significant user base.”

“The search engine arena is fiercely contested, and Google’s established user habits make it difficult for Bing’s AI enhancements to drive a notable shift in market share. Microsoft continues to grapple with the formidable task of altering user preferences in the face of Google’s search supremacy,” he added.

Google’s Dominance as an Entrenched Search Engine Vendor

Rob Enderle, president and principal analyst at the Enderle Group, an advisory services firm in Bend, Ore., pointed out that Google is an entrenched vendor.

“It takes quite a bit to take down an entrenched vendor,” he told TechNewsWorld. “People build up habits. They’re used to using Google.”

He explained that a large amount of marketing is needed to displace an entrenched vendor. “You’ve got to make people dislike the tool they’re using because if the tool they’re using is good enough, they don’t care,” he said.

“You’ve got to convince people not only that your tool is better, but you’ve got to convince them that what they’re using isn’t good enough,” he added.

Getting people to use the new AI Bing presented them with a pair of challenges, he continued, moving them to a new application and then inducing them to use AI.

“There’s a learning curve to doing AI right, and we’re talking about many people who couldn’t learn Boolean logic to do Google right,” he quipped.

“It’s a powerful platform, but it requires training to use it, and people don’t like to train,” he added.

Enderle maintained that the separation between where Bing has to be in order to pull and hold market share from Google and where it is significant.

“Microsoft needed to go farther with generative AI so you could just ask it a question verbally and get the curated response you want,” he said. “That wasn’t what was brought out, and the result was not as many people gravitated to it as Microsoft thought they would.”

Antitrust Trials and Tribulations

If AI can’t improve the search share of Google’s competitors, then maybe the court system can. Two antitrust trials are currently challenging the search leader’s alleged monopolistic practices.

In San Francisco, a trial is underway to settle a lawsuit filed by Epic Games, the studio behind the popular game Fortnite, against Google for antitrust issues related to in-game payment processing on the Google Play platform. The case alleges that Google has created an illegal monopoly on Android apps primarily to boost its profits through commissions ranging from 15% to 30% on purchases made within an app.

Meanwhile, in Washington, D.C., the U.S. Department of Justice and Google are wrangling in a courtroom over alleged antitrust violations by the search leader. The DOJ contends Google:

- Uses exclusionary agreements and practices to dominate the search engine market, such as requiring its search to be the default on Android devices;

- Uses its search dominance to give its own services an unlawful advantage over competitors;

- Suppresses competition in advertising technology markets through exclusionary conduct; and

- Stifles competition and harms consumers through less choice, lower quality, and higher prices for online services.

Will Legal Cases Affect Google’s Search Supremacy?

If Google loses the DOJ case, will its search share be affected?

“If the default search relationships are ended, that may not have a material impact on Google. People will continue to use it,” Sterling said.

“The ad-side may offer more significant options for the court,” he continued. “Right now, there aren’t a lot of things that the court can do on the consumer side to affect Google usage.”

What the court decides to be a remedy for Google’s monopolistic practices will determine if there’s any change in the status quo, Enderle added.

“If it’s just a monetary hit that Google can afford, there’ll be no difference,” he said. “But if it’s a huge monetary hit — as we saw when the EU hit Microsoft with billion-dollar fines — Google may change right away.”

Social Media

See all Social Media